Funding Account Liquidity

Funding Account Liquidity Management

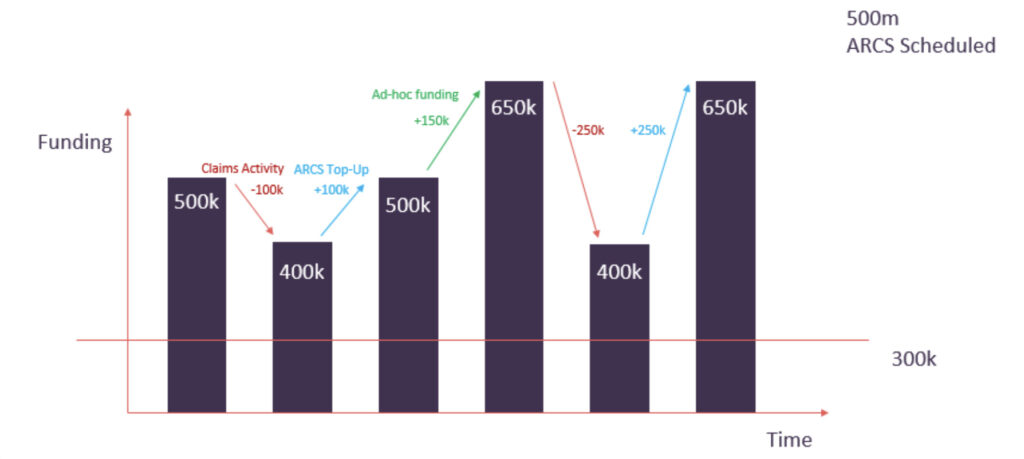

- A recent scenario was raised within the MUG, where an MA experienced a claims spike. Under the FCP ARCS

mechanism, funds used in payments to claimants, will always be replenished via automated ARCS top up. - Where a spike in claims is experienced – the best practice recommendation is to allow the ARCS Top-Up to take place and then replenish funds back to the Lloyd’s trust account in order to manage liquidity.

- Use of any non-FCP payment (E.g. Vitesse traditional loss-fund model) is outside of the LIMOSS managed contract.

FCP inherently ties top-ups to claims activity

Scenario 1 – Ring Fencing for Peaks in Claim Payments (connecting points raised in prior forums)

A number of DCA’s have raised concern about accessing liquidity during peak times. In the traditional world, many DCA’s would request specific split loss funds be funded and maintained to account for peak claim periods. During the FCP Pilot, one MA chose to run a version of this model – splitting payment accounts into distinct CAT season facilities for use by the DCA’s. It should be noted however that in this case, the payment accounts, whether “CAT” or “non-CAT” were all funded by the same MA Funding Account(s). Thereby requiring that the MA maintained a close control and forecast on liquidity requirements and ensured that they deposited excess funding when needed.

In an alternative scenario, it may be possible for Vitesse to provide separate funding accounts, to create not only CAT/Peak payment accounts, but also to hold those funds separate from the main non-peak business activity of

the Managing Agent. This would require a platform change.

In ALL cases, where a DCA has requested funding/further liquidity to prevent payments from failing, the Managing Agent (Lead or Follow) is obliged to provide funding as quickly as possible and to ensure that the requesting DCA is notified when the funding has cleared to the FCP account.

Scenario 2 – ARCS Top Ups

- Example 1 – In the example shared with the group on 27.6, a specific MA needed to make an unusual peak payment to cover a surge in claims. To do this, they had pushed adequate funding to their FCP funding account to enable the payments. The ARCS mechanism would then draw this same value down to ‘top-up’ funds. The MA in question, did NOT want those funds to be drawdown again and have to repatriate back to their Trust Account at the earliest possibility. (c. 5-6 day turnaround).

- Example 2 – A Claim payment was made via e-check in the usual way via the payment account, and the relevant ARCS top up triggered to replenish the funding accounts. Later the e-check was cancelled down and returned to the payment account, to be split and allocated back to the relevant funding accounts. Subsequently a second e-check was drawn down and a second ARCS top up triggered. The funding account now has 2 x the value of the claim in the account.

ARCS top-ups are triggered into funding accounts and values calculated according to outgoing claim values paid. They do NOT take into account payment returns, subrogation, additional funding deposits or excess payments into the payment or funding accounts.

When returns go back to the Funding Account, they are not automatically returned to the Trust Fund. The MA must repatriate any funds. Funding alerts can be setup to inform MAs when returned funds credit funding account

MUG is invited to comment on both scenarios – do either items need a new change to be added to backlog.